![]()

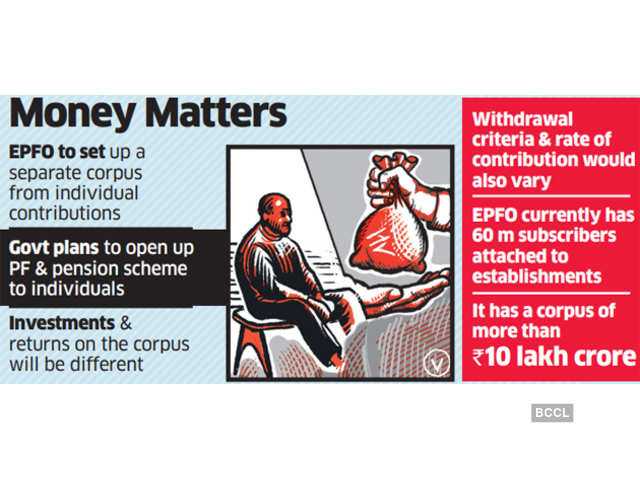

The government could create a separate fund under the Employees’ Provident Fund Organisation (EPFO) for contributions from individuals who join the scheme voluntarily once it is thrown open to everyone.

A launch date for this fund would be announced separately when the scheme is made universal, said officials. A separate fund is being considered to ensure the new individual subscribers do not draw upon the benefits of years of investments of more than 60 million EPFO subscribers from the existing corpus of over Rs 10 lakh crore.

The EPFO has retained 8.5% return for this financial year, much higher than about 7% available on small savings schemes. “Discussions are on within the labour ministry to set up a separate corpus for individuals once the EPFO scheme is opened for all,” a senior government official told ET on condition of anonymity. “We cannot allow new individuals to reap benefits of the longterm investments of EPFO.” Currently, the EPFO’s provident fund scheme is available to establishments and workers who are in a formal employee-employer relationship. Self-employed individuals such as chartered accountants, doctors and lawyers are not eligible to subscribe to the scheme.

However, the scheme will soon be available to all individuals, including the self-employed, much like the National Pension System (NPS). Individuals who voluntarily subscribe to the EPFO would get returns depending on the earnings of the new fund, and their withdrawal criteria could also be different, said officials. This would require amendment to the Employees’ Provident Fund & Miscellaneous Provisions Act, which governs 24% contribution, 12% each from employee and employer, to the provident and pensions schemes under the EPFO.

The Code on Social Security, 2020, empowers the government to frame any other scheme or schemes for the purposes of providing social security benefits to self-employed workers or any other class of persons.

Changes could be made once the four labour codes get implemented, said officials. The code envisions a universal social security for all its workers and employed people in the country.

Opening up the EPFO scheme to individuals would considerably widen the social security net while bringing millions of workers under the formal headcount. Only about 10% of the country’s 500 million workforce is in the organised sector, leaving a major chunk of working people out of any formal social security protection.

We are providing practical training (Labor Laws, Payroll, Salary Structure, PF-ESI Challan) and Labor Law, Payroll Consultant Service & more:

- HR-Generalist-Practical-Training: https://oneclik.in/hr-generalist-practical-training/ (PF, ESI, Bonus, Payroll & more)

- Labour Code | Labour Bill (Labour-Law-Practical-Training): https://oneclik.in/labour-law-practical-training/ (Factory, Contact Labor, Maternity Act & more)

- PF – ESI Consultant Service: https://oneclik.in/pf-esi-consultant-service/

- Labor Law, Compliance & HR – Payroll Management

- Advance Excel Practical Training

Get Latest HR, IR, Labor Law Updates, Case Studies & Regular Updates: (Join us on Social Media)

- Telegram Channel: “One Clik”

- Whatsapp Group: https://wa.me/919033016939

- Facebook: One Clik

- Linkedin: One Clik

- Instagram: oneclik_hr_management

- YouTube: One Clik