EPF Act Can Be Applied Even To Factories Not Engaged In Schedule 1 Industries: Supreme Court Rejects Plea Of Umbrella Making Unit

![]()

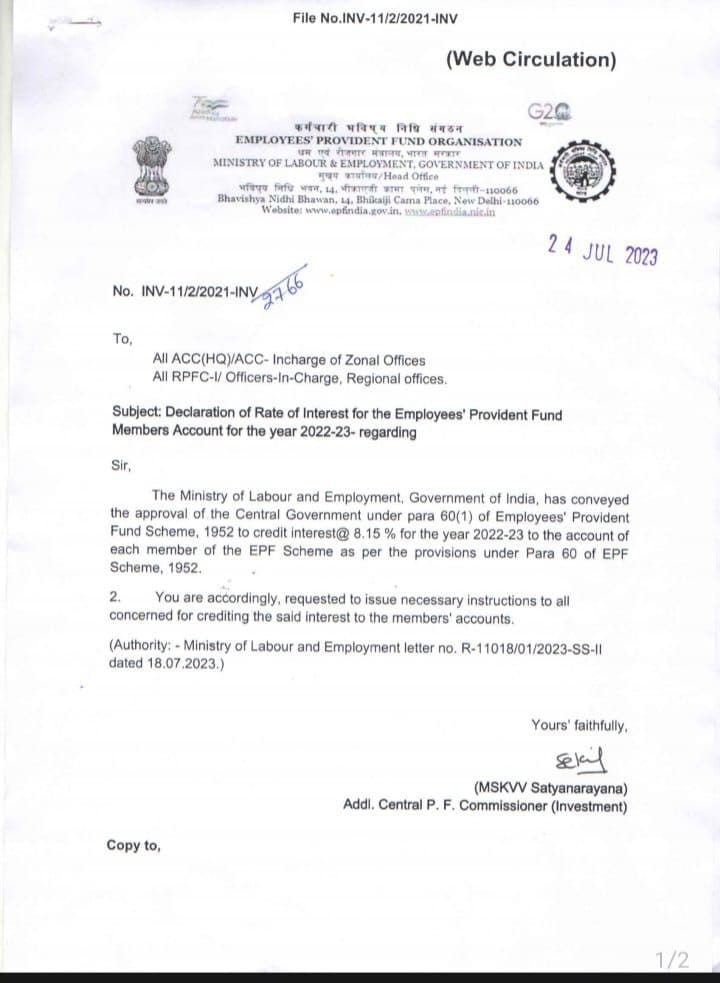

Case: THANKAMMA BABY v. THE REGIONAL PROVIDENT FUND COMMISSIONER Coram: Justice Abhay S Oka and Justice Sanjay Karol Case no.: CIVIL APPEAL NO. 4619 OF 2010 Court Observation: “We are dealing with a social welfare legislation described by the Constitution Bench as a measure of social justice. Therefore, to give effect to the legislature’s intention, the Court will have […]