![]()

Air India is paying much less than the Employees Provident Fund Organisation (EPFO)-approved interest rate on provident fund savings of its employees that are managed by its own PF trusts, people familiar with the matter said.

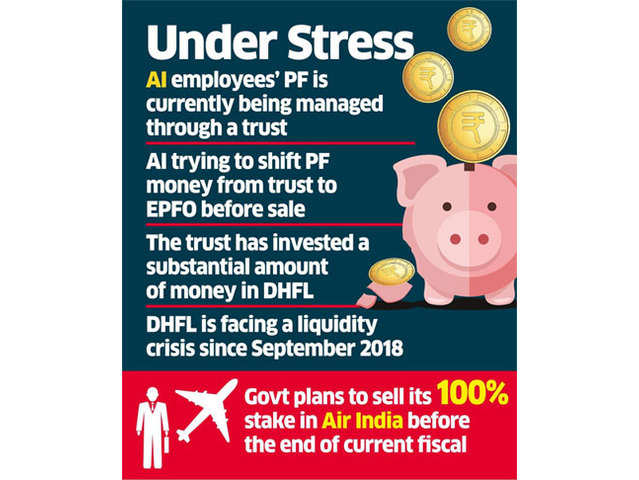

The privatisation-bound national carrier – which incurred significant losses on PF money of its employees due to investments in troubled firm Dewan Housing Finance (DHFL) – has sought employees approval to move their PF accounts to EPFO.

However, according to the sources, Air India recently told its employees that they may have to fund the investment losses if the government does not agree to fund those losses ahead of its disinvestment.

Losses to Air India PF trusts could be more than ₹100 crore, they said. Some others said it could be higher. “A large number of employees are worried as a lower interest rate and losses would impact our retirement benefit,” said a senior Air India official who did not want to be identified.

EPFO has approved an interest rate of 8.5% for the current year and AI employees are getting less than that, sources said.

Air India did not share any details over email sent on the issue. “We do not make any comment on internal issues of Air India,” a company spokesperson said in an email.

The airline is looking to shift employees’ PF accounts to EPFO in an attempt to find a solution to the situation before it finds a new owner.

“As you are aware the disinvestment of Air India is currently in an advanced stage and in this eventuality Air India will automatically come within purview of the Employees’ Provident Fund & Miscellaneous Provision Act,” it said in a July 27 order. Employees have the option of moving to EPFO, it said. However, loss during the process of shift to EPFO may have to be borne by the employees if the government does not agree to help AI on this, it said.

ET has seen a copy of the letter.

“For the transfer to EPFO, post PF accumulation of each employee along with cash will be required to be transferred to EPFO,” it said.

“This would entail the requirement of premature liquidation/sale of securities held by the trusts. This exercise may result in surplus/shortfall in the corpus depending on the market conditions.”

The airline said it is seeking government help to fund those losses.

How useful was this post?

- Share review with rating here: Google Review

We are providing practical training (Labor Laws, Payroll, Salary Structure, PF-ESI Challan) and Labor Codes, Payroll Consultant Service & more:

- HR Generalist Practical Training: https://oneclik.in/hr-generalist-practical-training/

- Labor Law + Payroll-Practical-Training: https://oneclik.in/labor-law-payroll-practical-training-certificate/ (PF, ESI, Bonus, Payroll & more)

- Labor Code, 2020 (Crash Course): https://oneclik.in/labor-code2020-rules-practical-training-certificate-crash-course/

- Labour Code | Labour Bill (Labour-Law-Practical-Training): https://oneclik.in/labour-law-practical-training/ (Factory, Contact Labor, Maternity Act & more)

- PF – ESI Consultant Service: https://oneclik.in/pf-esi-consultant-service/

- Labor Law, Compliance & HR – Payroll Management

- Advance Excel Practical Training: https://oneclik.in/advanced-excel-practical-training-certificate/

Get Latest HR, IR, Labor Law Updates, Case Studies & Regular Updates: (Join us on Social Media)

- Telegram Channel: “One Clik”

- Whatsapp Group: https://wa.me/919033016939

- Facebook: One Clik

- Linkedin: One Clik

- Instagram: oneclik_hr_management

- YouTube: One Clik