![]()

According to the report of Zee Business, EPFO has changed a rule to withdraw provident fund. Under this new provision, individuals will not be able to withdraw their PF amount through offline mode. In fact a condition applies even in the online process!

Changes in EPF Withdrawal Rules

According to the latest PF withdrawal rules, individuals whose Aadhaar number is linked with the Universal Account Number (UAN) of EPFO (Employee Provident Fund)! They will not be able to claim PF (Provident Funds) withdrawal offline as per Zee Business Business.

In such a case, the Employees’ Provident Fund Organization (EPFO) has refused to accept the offline claim. The report claims further! Regional Commissioner NK Singh told Zee Business, “The EPFO (Employee Provident Fund) has taken this decision due to the increasing number of offline claims in the field office!”

Many firms were receiving bulk claims of EPF (Employee Provident Fund) claim. Employees whose Aadhaar is linked with offline UAN through physical forms. After which the EPFO (Employee Provident Fund) has issued a circular in this regard directing the companies not to accept offline claims.

Let’s know about this new change

- If your Aadhaar number is linked to Universal Account Number (UAN) of EPF (Employee Provident Fund) So you will not be able to claim for withdrawal of provident fund offline. The Employees’ Provident Fund Organization (EPFO) has refused to accept the offline claim in such a case.

- If you understand in simple words then your Aadhaar is linked with UAN. So you have to claim online to get PF! According to Regional Commissioner NK Singh, the EPFO field office has taken this decision due to the increasing cases of offline claims in the field office.

- Why did EPFO take this decision – a circular has been issued by EPFO in this regard. Companies were claiming such members in bulk in physical form whose Aadhaar is linked with UAN. Due to this the burden of force in the field office was increasing.

- It also delays claim settlement. In such cases the companies will not accept the offline claim and the companies are advised to use the online claim service platform.

Online claim will be settled –

It has been said in the EPF (Employee Provident Fund) circular! That if a member files a claim both online and offline, then only the online claim will be settled.

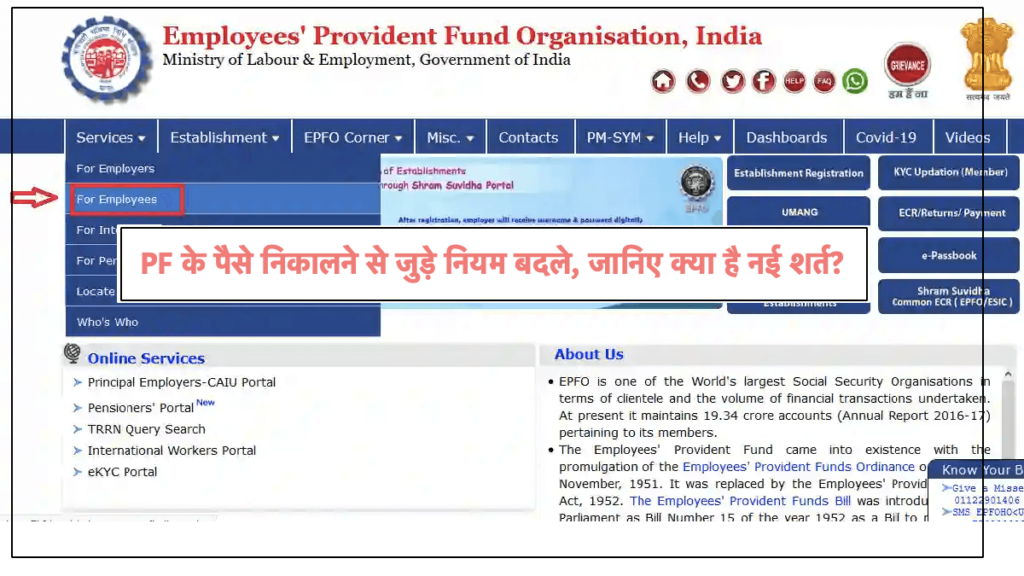

How to submit claim online – For online claim submission you have to visit EPF (Employee Provident Fund) website http://www.epfindia.com. Here you will see the option of online claim. On clicking on the online claim option http://unifiedportal-mem.epfindia.gov.in/ link will open.

Here the member has to feed his Universal Account Number i.e. UAN and Password. After this there will be an option to submit a claim. After this the withdrawal form will not have to be submitted to the company. Important things – There is no need to submit PF (Employees Provident Funds) withdrawal form in the company to get PF. Once the claim is made online, the field officer will automatically verify the claim. For this it is necessary that your KYC is completed on the Unified Portal.

How useful was this post?

- Share review with rating here: Google Review

We are providing practical training (Labor Laws, Payroll, Salary Structure, PF-ESI Challan) and Labor Codes, Payroll Consultant Service & more:

- HR Generalist Practical Training + Certificate: https://oneclik.in/hr-generalist-practical-training/

- Labor Law + Payroll Practical Training + Certificate : https://oneclik.in/labor-law-payroll-practical-training-certificate/ (PF, ESI, Bonus, Payroll & more)

- HR Analytics Practical Training + Certificate: https://oneclik.in/hr-analytics-practical-training-certificate/

- Labor Code, 2020 (Crash Course) + Certificate: https://oneclik.in/labor-code2020-rules-practical-training-certificate-crash-course/

- Advance Excel Practical Training + Certificate: https://oneclik.in/advanced-excel-practical-training-certificate/

- Disciplinary Proceeding & Domestic Enquiry – Practical Training + Certificate: https://oneclik.in/disciplinary-proceeding-domestic-enquiry-short-term-course-with-latest-updates/

- PoSH Act, 2013 ( Sexual Harassment Of Women At Workplace & Vishaka Guidelines) – Practical Training + Certificate: https://oneclik.in/sexual-harassment-of-women-at-workplace-vishaka-guidelines-short-term-course-with-latest-amendments/

- Labour Code (2019 & 2020) With Latest Updates | Labour Bill (Labour-Law-Practical-Training): https://oneclik.in/labour-law-practical-training/ (Factory, Contact Labor, Maternity Act & more)

- PF – ESI Consultant Service: https://oneclik.in/pf-esi-consultant-service/

- Labor Law, Compliance & HR – Payroll Management

Get Latest HR, IR, Labor Law Updates, Case Studies & Regular Updates: (Join us on Social Media)

- Telegram Channel: “One Clik”

- Whatsapp Group: https://wa.me/919033016939

- Facebook: One Clik

- Linkedin: One Clik

- Instagram: oneclik_hr_management

- YouTube: One Clik

Disclaimer: All the information on this website/blog/post is published in good faith, fair use & for general informational purposes only and is not intended to constitute legal advice.