![]()

Download: Official Gazette

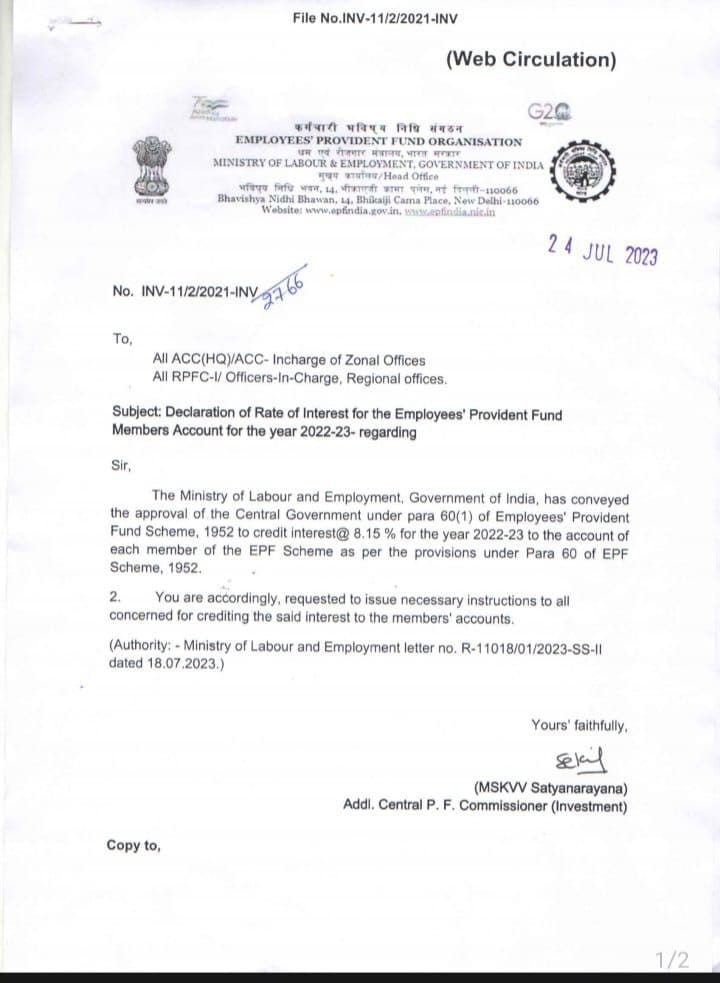

The Union finance ministry has notified the rate of interest for provident fund contributions at 8.15% for 2022-23.

“The Ministry of Labour and Employment, Government of India, has conveyed the approval of the Central Government under para 60 (1) of Employees’ Provident Fund Scheme, 1952 to credit interest for the year 2022-23 to the account of each member of the EPF Scheme…,” said a circular by the Employees’ Provident Fund Organisation (EPFO).

This would enable the EPFO to credit the 8.15% rate of interest to subscribers on their PF contributions for last fiscal.

The Central Board of Trustees of the EPFO, which is chaired by Union Labour and Employment Minister Bhupender Yadav, had on March 28 recommended the 8.15% interest rate for FY23.

Following the recommendation of the CBT, the rate of interest has to be approved and notified by the finance ministry. It is only then that it can be credited into members’ accounts. Typically, the interest rate is notified by the finance ministry in the first quarter of the fiscal and subscribers were waiting for the notification for FY23.

The 8.15% interest rate for EPF contributions for FY23 is just a tad higher than the multi-decadal low 8.1% interest rate for FY22. Prior to this, the lowest interest rate on PF deposits was 8% in 1977-78.

Members have been hoping for a higher interest rate on their EPF contributions but the decision on the rate of interest is based on the projected income of the retirement fund manager. For FY23, the EPFO is projected to have an income of Rs 90,497.57 crore.

The EPFO is the country’s largest retirement fund manager with 70.2 million contributing members and 0.75 million contributing establishments. Interest credit for FY22 was delayed for subscribers due to software issues as the passbook of subscribers had to be split into taxable and non-taxable contributions. This was due the income tax on EPF savings’ income that was introduced in 2021-22 on contributions above Rs 2.5 lakh.

How useful was this post?

- Share review with rating here: Google Review

We are providing practical training (Labor Laws, Payroll, Salary Structure, PF-ESI Challan) and Labor Codes, Payroll Consultant Service & more:

- HR Generalist Practical Training + Certificate

- Labor Law + Payroll Practical Training + Certificate

- HR Analytics Practical Training + Certificate

- Labor Code, 2020 (Crash Course) + Certificate

- Advance Excel Practical Training + Certificate

- Disciplinary Proceeding & Domestic Enquiry – Practical Training + Certificate

- PoSH Act, 2013 (Sexual Harassment Of Women At Workplace & Vishaka Guidelines) – Practical Training + Certificate

- Compensation & Benefits – Practical Training + Certificate

- Industrial Relations – Practical Training + Certificate

- Labour Code (2019 & 2020) With Latest Updates | Labour Bill (Labour-Law-Practical-Training)

- PF – ESI Consultant Service

- Labor Law Consultant | Compliance Management | HR & Payroll Outsourcing

Get Latest HR, IR, Labor Law Updates, Case Studies & Regular Updates: (Join us on Social Media)

- Telegram Channel: The One Clik

- Whatsapp Group: https://wa.me/919033016939

- Facebook: The One Clik

- Linkedin: The One Clik

- Instagram: oneclik_hr_management

- YouTube: The One Clik

Disclaimer: All the information on this website/blog/post is published in good faith, fair use & for general informational purposes only and is not intended to constitute legal advice.