![]()

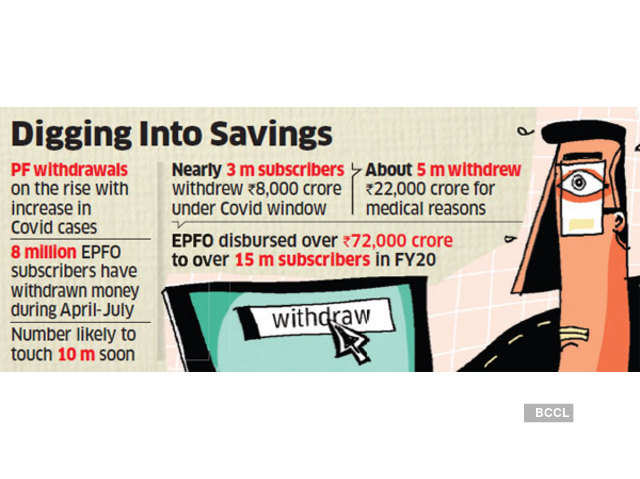

NEW DELHI: As much as Rs 30,000 crore has been withdrawn in under four months starting April by 8 million subscribers of the Employee Provident Fund Organisation. EPFO manages a corpus of Rs 10 lakh crore built on mandatory contributions from nearly 60 million salaried people and their employers. The huge outgo is likely to impact the fund’s earnings in FY21, officials said.

EPFO officials told ET the amount withdrawn between April and the third week of July is much more than the usual outgo seen over similar periods, and that pandemic-related job losses, salary cuts and medical expenses explain this substantial increase.

“Of the total withdrawals, nearly 3 million beneficiaries withdrew upwards of Rs 8,000 crore under the Covid window while the rest Rs 22,000 crore was a general withdrawal by 5 million EPFO subscribers, mainly as medical advance,” an EPFO official said.

A special Covid window for withdrawals was announced by finance minister Nirmala Sitharaman soon after India declared a nationwide lockdown in late March to contain the spread of the pandemic. The Finance Investment and Audit Committee (FIAC) of the retirement fund body updated its members on withdrawals at a virtual meeting held last week, people familiar with the deliberations at the meeting told ET.

Officials said the full impact on returns of this large withdrawal will be known after “detailed micro-level analysis”.

“With Covid cases on the rise, the number of withdrawals are going up faster,” a top government official said.

Going by the current trend, EPFO expects nearly 10 million subscribers to withdraw from their savings in the coming days.

We are providing practical training (Labor Laws, Payroll, Salary Structure, PF-ESI Challan) and Labor Law, Payroll Consultant Service & more:

- HR-Generalist-Practical-Training: https://oneclik.in/hr-generalist-practical-training/ (PF, ESI, Bonus, Payroll & more)

- Labour-Law-Practical-Training: https://oneclik.in/labour-law-practical-training/ (Factory, Contact Labor, Maternity Act & more)

- PF – ESI Consultant Service: https://oneclik.in/pf-esi-consultant-service/

- Labor Law, Compliance & HR – Payroll Management

- Advance Excel Practical Training

To Get Latest HR, IR, Labor Law Updates, Case Studies & Regular Updates: (Join us on Social Media)

- Telegram Channel: “One Clik”

- Whatsapp Group: https://wa.me/919033016939

- Facebook: One Clik

- Linkedin: One Clik

- Instagram: oneclik_hr_management

- YouTube: One Clik