![]()

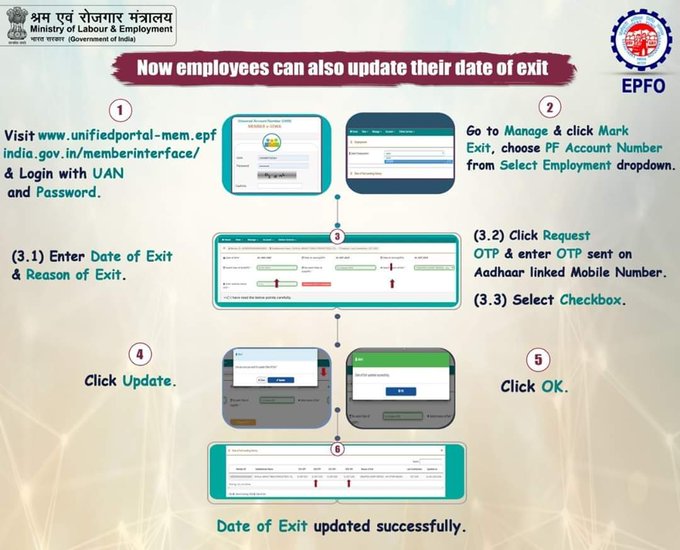

If you are an account holder with the Employees’ Provident Fund Organisation (EPFO) and want to update your date of exit of the previous employment, you can easily do it. The retirement fund body has now made it easy for the employees to do it by themselves. Here is a step-by step guide to do it.

Your guide to update date of exit:

1) Visit the unified portal and log in with your UAN id and Password. UAN is a Universal Account Number given to each account holder.

2) After you are logged in, go to the ‘Manage’ and click Mark Exit. Choose PF account number from ‘Select Employment’ dropdown.

3) Then enter the date of exit along with the reason of exit. Click on ‘request OTP’ option and enter OTP which is received on your registered mobile number. Select the checkbox.

4) Click update and then click Ok.

- After gap of 2 month from last month contribution.

If you do have a UAN or have still not received it from your employer, you can generate it too, without much difficulty. But you must also know that you will be able to generate UAN only if the organization you work for, is registered with the EPFO. UAN is a 12 digit number allotted to every employee registered with the retirement fund body.

How to generate UAN?

1) Go the UAN Portal https://unifiedportal-mem.epfindia.gov.in/memberinterface/

2) Click on the tab ‘Know your UAN Status’. A ‘Know Your UAN’ page will appear before you.

3) Select your state and EPFO office from the dropdown menu and enter your PF number/member ID along with the other details such as your name, date of birth, mobile number and captcha code. Your PF number/member ID will be mentioned in your salary slips. Now enter the tab ‘Get Authorization Pin’.

4) You will now receive a PIN on your mobile number. Enter the PIN and click on the ‘Validate OTP and get UAN’ button.

5) Your UAN will be sent to your mobile number. You can save it for future use.

We are providing practical training (Labor Laws, Payroll, Salary Structure, PF-ESI Challan) and Labor Law, Payroll Consultant Service & more:

- HR-Generalist-Practical-Training: https://oneclik.in/hr-generalist-practical-training/ (PF, ESI, Bonus, Payroll & more)

- Labour Code | Labour Bill (Labour-Law-Practical-Training): https://oneclik.in/labour-law-practical-training/ (Factory, Contact Labor, Maternity Act & more)

- PF – ESI Consultant Service: https://oneclik.in/pf-esi-consultant-service/

- Labor Law, Compliance & HR – Payroll Management

- Advance Excel Practical Training

Get Latest HR, IR, Labor Law Updates, Case Studies & Regular Updates: (Join us on Social Media)

- Telegram Channel: “One Clik”

- Whatsapp Group: https://wa.me/919033016939

- Facebook: One Clik

- Linkedin: One Clik

- Instagram: oneclik_hr_management

- YouTube: One Clik