![]()

After you have uploaded or submitted your ITR (income tax return) on the income-tax (I-T) e-filing portal, you get 120 days to verify your return. If you fail to verify your tax return within this stipulated time, then it is considered invalid as per current I-T laws. A return may be verified either by sending a signed copy of ITR-V to CPC (centralised processing centre), Bengaluru through speed post/ordinary post or by e-verification through online modes.

The central board of Direct taxes (CBDT) has decided to provide a one-time relaxation for verification of e-filed ITRs for assessment years (AYs) 2015-16 to 2019-20, which may be done by sending a signed hard copy of ITR-V to CPC, Bengaluru or via online modes latest by 30 September 2020.

There are six ways to verify your ITR. Out of these, five are electronic methods and one is a physical method. These methods can be used only if you are filing tax returns which are not required to be audited, i.e., usually ITR-1, ITR-2 and ITR-4 for FY19-20. However, if you are filing your tax returns which are required to be audited, then you have to verify it using the ‘digital signature certificate’.

1. Aadhaar-based OTP (One Time Password): To verify your ITR using the Aadhaar-based one-time password (OTP), your mobile number must be linked to Aadhaar and registered as such in the Unique Identification Authority of India (UIDAI) database and your PAN must be linked with Aadhaar.

Log in to the income tax e-filing portal and under the ‘My Account’ tab, click on ‘e-verify return’ and select the option, ‘I would like to generate Aadhaar OTP to e-verify my return.’ A text message with a six digit OTP will be sent to your registered mobile number. Enter the OTP (valid only for 30 minutes) received by you and click on submit and your ITR will be e-verified.

In case your mobile number is not linked to your Aadhaar, then you could use other ways to electronically verify your ITR.

2. Using Netbanking To E-verify

You can e-verify your ITR if you have availed the netbanking facility of your bank account. Only select banks allow you to e-verify your ITR. Here is a list of banks which offer you this option to e-verify via netbanking.

To verify your ITR using netbanking facility, login to your bank account on the bank’s portal. Choose the e-verify option which is commonly found under the ‘tax’ tab. You will be then redirected to the e-filing website of the income tax department. Hence, before logging in to your bank account, ensure that you are not already logged in on the e-filing portal.

For example, for ICICI Bank, select ‘Payments & Transfer’ Menu, go to the ‘Tax Center’ tab and click on ‘Income Tax e-Filing’ option to login to I-T department portal. You will be re-directed to the e-filing portal of the I-T department where you can proceed to submit and e-verify your return.

Click on ‘e-File’ tab and select ‘Income Tax Return’ from the drop down menu. Select the ‘Assessment Year’, ‘ITR For Name’ & ‘Submission Mode’ & click ‘Continue’. Submit your return/ upload the XML. ITR Verification is complete.

3. Using Bank Account Number To Verify

For this process to work, your PAN has to be registered with the bank and you need to pre-validate your bank account on the I-T portal (in case you have not already done it) after you log in. Go to I-T e-filing portal and under profile settings, select pre-validate bank account and fill in all the details and submit to pre-validate bank account.

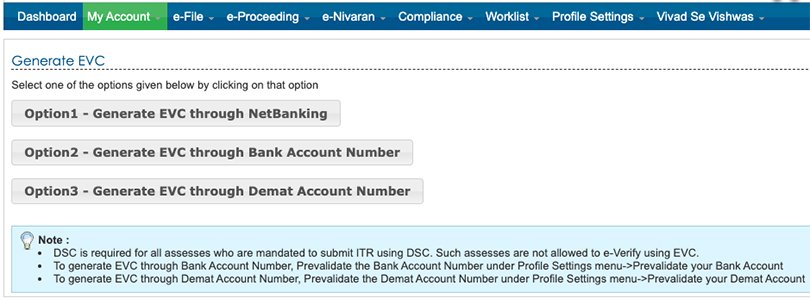

Log in to the I-T e-filing portal. Under the ‘My Account’ tab, choose the ‘Generate EVC’ option. Here you can choose either through netbanking or through bank account number options. A 10-digit alpha-numeric EVC (electronic verification code) will be sent to your email address and mobile number. This code is valid for 72 hours. Then, go to the ‘e-verify’ option under the ‘My Account’ tab to verify your return. Select the option ‘I have EVC already’ and enter the EVC that you have received on your mobile number registered with the bank. Click on ‘Submit’ and your ITR will be verified.

4. Using Demat Aaccount Number To Verify

If you are a demat account-holder, you can use your demat account to verify your ITR. This method is similar to the bank account based ITR validation. You must pre-validate your demat account to verify your tax return. Go to the profile settings tab and choose pre-validate demat account and enter the required details such as mobile number, email ID, and your depository name, i.e., NSDL or CDSL. You need to your enter mobile number and email ID which is linked to the demat account.

The pre-validation process is automatic and usually takes about 1-2 hours and if there is any error then it is communicated to you via email. You can use your demat account to generate EVC only after your details are validated by your depository. Remember, you will be unable to change your mobile number or email ID without revalidating it with the depository.

You need to pre-validate your demat account number and then you can choose the third option seen in the screenshot above ‘Generate EVC through demat account number’. A 10-digit alpha-numeric code will be sent to your email address and mobile number. This code is valid for 72 hours. Then, go to the ‘e-verify’ option under the ‘My Account’ tab to verify your return. Select the option ‘I have EVC already’ and enter the EVC that you have received on your mobile number registered with your demat account number.

5. Using Bank ATM To Verify:

Swipe your debit card in the bank’s ATM machine. Enter your PIN and choose e-filing option. Opt for EVC (valid for 72 hours) to be sent to your registered mobile number. Log in to income tax e-filing portal and choose e-verify using EVC obtained via bank ATM. Enter the EVC in the space provided and submit. Your ITR is e-verified.

6. Send Hard Copy Signed Print Out to the Bengaluru CPC

If you are unable to e-verify your ITR using any of these electronic methods mentioned above, then you can send a signed copy of ITR-V (income tax return verification/acknowledgement receipt) to the CPC. However, please note the following points:

1. ITR-V is a one-page document which must be signed in blue ink. It must be sent either via ordinary post or speed post. You cannot courier ITR-V and cannot use registered AD.

2. Address of CPC Bangalore for speed post: CPC, Post Box No – 1, Electronic City Post Office, Bangalore – 560100, Karnataka, India’.

3. You are not required to send any supporting document along with the ITR-V.

4. You will receive a text message on your mobile phone and an email on your email ID once your ITR is received by the tax department. This intimation is only for receipt of ITR-V, the intimation for processing of tax return is separate.

5. If you have verified your ITR using any of the electronic methods mentioned earlier, you are not required to send ITR-V to the I-T department.

We are providing practical training (Labor Laws, Payroll, Salary Structure, PF-ESI Challan) and Labor Law, Payroll Consultant Service & more:

- HR-Generalist-Practical-Training: https://oneclik.in/hr-generalist-practical-training/ (PF, ESI, Bonus, Payroll & more)

- Labour-Law-Practical-Training: https://oneclik.in/labour-law-practical-training/ (Factory, Contact Labor, Maternity Act & more)

- PF – ESI Consultant Service: https://oneclik.in/pf-esi-consultant-service/

- Labor Law, Compliance & HR – Payroll Management

- Advance Excel Practical Training

To Get Latest HR, IR, Labor Law Updates, Case Studies & Regular Updates: (Join us on Social Media)

- Telegram Channel: “One Clik”

- Whatsapp Group: https://wa.me/919033016939

- Facebook: One Clik

- Linkedin: One Clik

- Instagram: oneclik_hr_management

- YouTube: One Clik