![]()

Need For Challan Correction

While depositing TDS payment to the Central Government Account using either Online or Offline mode, following errors can occur at the Deductor’s end or Bank’s end:-

1. Mentioned Other TAN Number

2. Mentioned PAN instead of TAN

3. Selected wrong Minor Head/Major Head

4. Selected wrong Assessment Year

5. Selected wrong Nature of Payment

6. Mentioned wrong amount of Tax Payment

Due to these errors TDS/TCS demand may raise on Deductor who needs to get these errors rectified as early as possible.

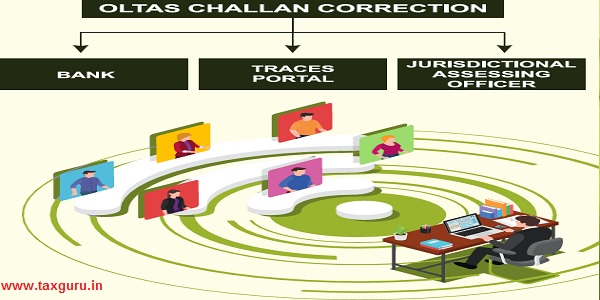

Mode of Challan Correction

Challan Correction can be done using the below mentioned modes

OLTAS CHALLAN CORRECTION BY BANK/JURISDICTIONAL ASSESSING OFFICER

| Type Of | Timelimit | Correction | Correction |

| Correction | Authority Within Timeline | Authority After The Expiry Of Timeline | |

| Tan To Tan Correction | Within 7 Days From Challan Deposit Date | Bank | Jurisdictional Assessing Officer |

| Pan To Tan Correction | Within 7 Days From Challan Deposit Date | Bank | Jurisdictional Assessing Officer |

| Major/Minor Head | Within 3 Months From Challan Deposit Date | Bank | Jurisdictional Assessing Officer |

| Nature Of Payment | Within 3 Months From Challan Deposit Date | Bank | Jurisdictional Assessing Officer |

| Total Tax Payment | Within 7 Days From Challan Deposit Date | Bank | Jurisdictional Assessing Officer |

OLTAS CHALLAN CORRECTION AT TRACES WEBSIIE

OLTAS Challan Correction Is the functionality provided by TDS CPC to the deductor for correction of the Unclaimed and Matched Challans.

Assessing Officer approval is not required if OLTAS Challan Correction is made through website for change In the following fields only as mentioned below:-

1. Financial Year- F.Y. can be corrected up to the Financial Year relating to Date of Deposit of challan.e.g., if challan is of F.Y. 2008-09 and Date of Deposit is 20-06-2016, F.Y. cannot be greater than 2016-17.

2. Minor Head Code (200 and 400) – Minor Head 200 and 400 is allowed for correction through OLTAS. Challan Correction available on TRACES.

3. Major Head Code (20/21)- Correction in Major Heads- 20 (Company) and 21 (Non-Company) can be corrected through OLTAS Challan Correction available on TRACES.

4. Nature of Payment — Correction in Section code except Section Code-195 is possible through OLTAS Challan Correction available on TRACES.

ONLINE TDS CHALLAN CORRECTION

Online correction of TDS challan has to be carried out on ‘TRACES’ (TDS Reconciliation Analysis and Correction Enabling System). Digital Signature is mandatory to register on TRACES for requesting online challan correction.

Steps for online correction on TRACES is as follows:

Step 1: Login to TRACES website with user ID, password and TAN (https://www.tdscpc.gov.in/app/login.xhtml)

Step 2: Under defaults, choose ‘Request for correction’.

Step 3: Enter Relevant Financial Year, Quarter, Form Type whether, Latest Accepted Token number.

Step 4: A request numberwill be generated.

Step 5: Click on ‘go To Track Correction Request’ under Defaults again and enter Request number or Request period and click on ‘View Request’ or you can also click on ‘View All Requests’.

Step 6: When request status** becomes `Available’ click on Available/ In progress status to proceed with the correction.

Step 7: Provide information of valid KYC.

Step 8: Select the type of correction category from the drop down as `Challan Correction’.

Step 9: Make the request corrections in the selected file.

Step 10: Click on ‘Submit for Processing’ to submit your correction.

Step 11: 15 digits token number will be generated and mailed to registered e-mail IDs.

We are providing practical training (Labor Laws, Payroll, Salary Structure, PF-ESI Challan) and Labor Code, Payroll Consultant Service & more:

- HR-Generalist-Practical-Training: https://oneclik.in/hr-generalist-practical-training/ (PF, ESI, Bonus, Payroll & more)

- Labour Code | Labour Bill (Labour-Law-Practical-Training): https://oneclik.in/labour-law-practical-training/ (Factory, Contact Labor, Maternity Act & more)

- PF – ESI Consultant Service: https://oneclik.in/pf-esi-consultant-service/

- Labor Law, Compliance & HR – Payroll Management

- Advance Excel Practical Training

Get Latest HR, IR, Labor Law Updates, Case Studies & Regular Updates: (Join us on Social Media)

- Telegram Channel: “One Clik”

- Whatsapp Group: https://wa.me/919033016939

- Facebook: One Clik

- Linkedin: One Clik

- Instagram: oneclik_hr_management

- YouTube: One Clik