![]()

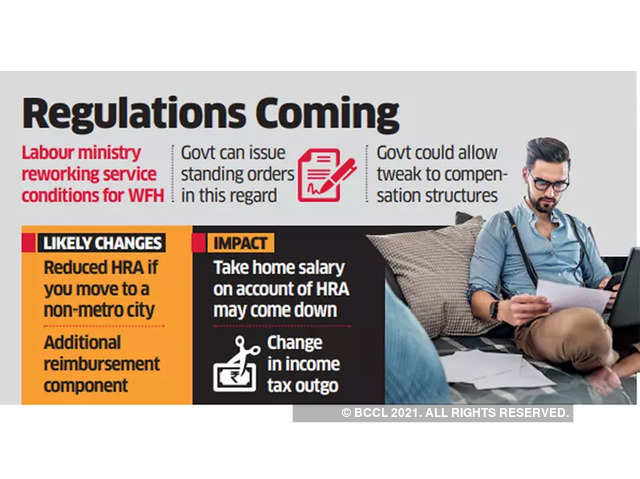

The labour ministry may soon allow employers to tweak the salary structure of existing employees who opt for work from home permanently.

This could entail a reduction in the house rent allowance (HRA) component of the employees and an increase in reimbursement cost under the infrastructure component.

A top government official told ET that the labour ministry may issue standing orders to redefine service conditions.

There is a need to redefine service conditions to ensure the employee compensation is structured taking into account the expenses incurred due to working from home, the official said.

Employees have to bear certain infrastructure costs such as electricity and WiFi and these need to be part of the compensation structure. From an employer’s point of view, the lower cost of living for an employee due to relocating to his or her hometown, in some instances to tier-2 and tier-3 cities, needs to reflect in the compensation package.

“The government is considering all the options and something concrete is likely to come soon,” the official added.

Prashant Singh, head and vice president, Teamlease Compliance & Payroll Outsourcing Business, said the employees opting for permanent work from home will have a change in salary stature, like in the components of HRA and professional tax.

Labour welfare fund is another issue, besides the applicability of state labour laws in such situations that needs to be clarified.

BC Prabhakar, chairman and advocate of BCP Associates and a labour law expert, feels legislation should be avoided as work from home is an evolving concept in India.

“Let the market determine the wage structure depending on the demand and supply of labour in the Indian market,” he said, adding that the management and the employee should be allowed to negotiate the service conditions as any intervention by the government would defeat the very purpose of working from home.

Impact on HRA

The most significant tax impact could be on the HRA component, if a worker moves to his home town under WFH.

Under the current rules, the tax rebate for HRA is the least of three: 1) the actual HRA received from the employer, 2) 50% of basic salary + dearness allowance for those living in metro cities and 40% for those living in non-metro cities, and 3) actual rent paid minus 10% of basic salary + DA.

If the HRA component is reduced and not replaced with something for which tax rebate is available, then the tax liability of the employee may rise.

“Any employee moving from a metro city to a non-metro city will have reduced take-home pay if the HRA goes down,” Singh of Teamlease said. “Change of HRA will have a direct impact on the income tax payment of the employee.”

While the reduction in HRA will lead to an increase in the tax outgo as well as additional provident fund contributions if the reduced HRA is added to the basic pay, adding an infrastructure component on the reimbursement portion will reduce the tax burden for employees.

How useful was this post?

- Share review with rating here: Google Review

We are providing practical training (Labor Laws, Payroll, Salary Structure, PF-ESI Challan) and Labor Codes, Payroll Consultant Service & more:

- HR Generalist Practical Training + Certificate: https://oneclik.in/hr-generalist-practical-training/

- Labor Law + Payroll Practical Training + Certificate : https://oneclik.in/labor-law-payroll-practical-training-certificate/ (PF, ESI, Bonus, Payroll & more)

- HR Analytics Practical Training + Certificate: https://oneclik.in/hr-analytics-practical-training-certificate/

- Labor Code, 2020 (Crash Course) + Certificate: https://oneclik.in/labor-code2020-rules-practical-training-certificate-crash-course/

- Advance Excel Practical Training + Certificate: https://oneclik.in/advanced-excel-practical-training-certificate/

- Disciplinary Proceeding & Domestic Enquiry – Practical Training + Certificate: https://oneclik.in/disciplinary-proceeding-domestic-enquiry-short-term-course-with-latest-updates/

- PoSH Act, 2013 ( Sexual Harassment Of Women At Workplace & Vishaka Guidelines) – Practical Training + Certificate: https://oneclik.in/sexual-harassment-of-women-at-workplace-vishaka-guidelines-short-term-course-with-latest-amendments/

- Labour Code (2019 & 2020) With Latest Updates | Labour Bill (Labour-Law-Practical-Training): https://oneclik.in/labour-law-practical-training/ (Factory, Contact Labor, Maternity Act & more)

- PF – ESI Consultant Service: https://oneclik.in/pf-esi-consultant-service/

- Labor Law, Compliance & HR – Payroll Management

Get Latest HR, IR, Labor Law Updates, Case Studies & Regular Updates: (Join us on Social Media)

- Telegram Channel: “One Clik”

- Whatsapp Group: https://wa.me/919033016939

- Facebook: One Clik

- Linkedin: One Clik

- Instagram: oneclik_hr_management

- YouTube: One Clik

Disclaimer: All the information on this website/blog/post is published in good faith, fair use & for general informational purposes only and is not intended to constitute legal advice.