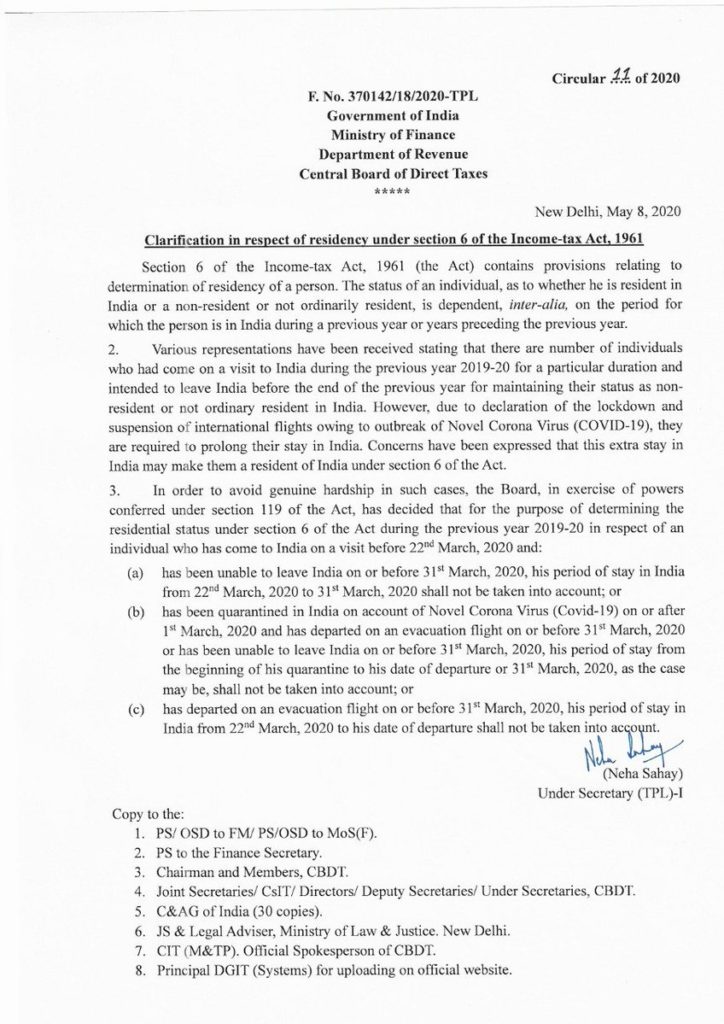

Centre Grants Relaxations To NRIs On ‘Residential Status’ Under Income Tax Act For FY 2019-20

![]()

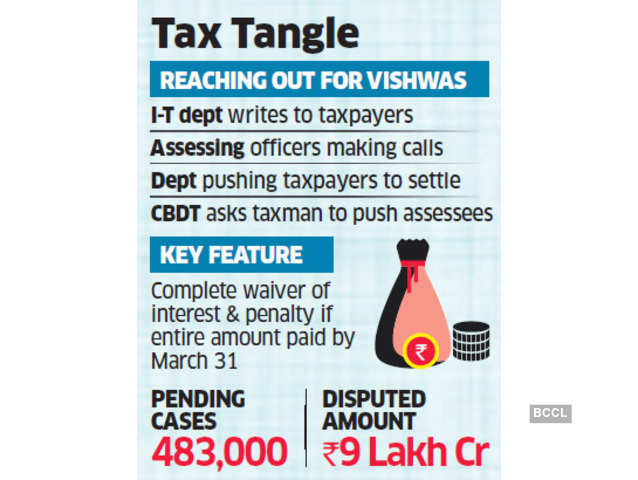

Taking note of the COVID-19 lockdown, the Central Government has granted relaxations to the criteria for determining ‘residential status’ under Section 6 of the Income Tax Act,1961, for the Financial Year 2019-20. As per Section 6 of Income Tax Act (before 2020 amendment), stay for 182 days or more in India during a financial year […]