![]()

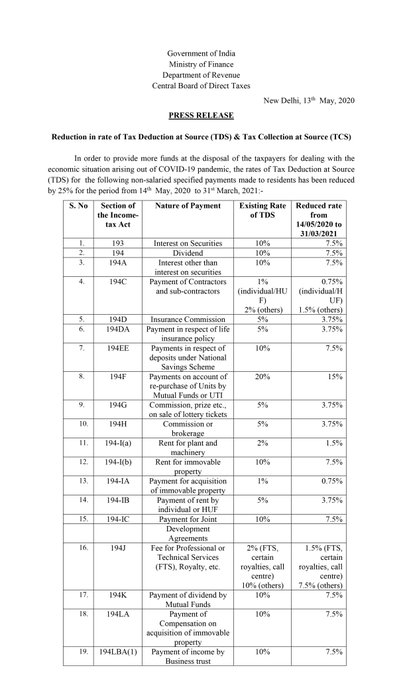

To provide more funds at the disposal of taxpayers for dealing with the economic situation arising out of COVID-19 pandemic, rates of TDS have been reduced by 25% for following non-salaried specified payments. Here is the table of existing & new reduced rates :

TDS Rate Chart For FY 2020-21 Pre & Post 14th May 2020:

| S. No | Section of the Income-tax Act | Nature of Payment | Existing Rate of TDS | Reduced rate from 14/05/2020 to 31/03/2021 |

| 1 | 193 | Interest on Securities | 10% | 7.5% |

| 2 | 194 | Dividend | 10% | 7.5% |

| 3 | 194A | Interest other than interest on securities | 10% | 7.5% |

| 4 | 194C | Payment of Contractors and sub-contractors | 1% (individual/HUF)2% (others) | 0.75% (individual/HUF)1.5% (others) |

| 5 | 194D | Insurance Commission | 5% | 3.75% |

| 6 | 194DA | Payment in respect of life insurance policy | 5% | 3.75% |

| 7 | 194EE | Payments in respect of deposits under National Savings Scheme | 10% | 7.5% |

| 8 | 194F | Payments on account of re-purchase of Units by Mutual Funds or UTI | 20% | 15% |

| 9 | 194G | Commission, prize etc., on sale of lottery tickets | 5% | 3.75% |

| 10 | 194H | Commission or brokerage | 5% | 3.75% |

| 11 | 194-I(a) | Rent for plant and machinery | 2% | 1.5% |

| 12 | 194-I(b) | Rent for immovable property | 10% | 7.5% |

| 13 | 194-IA | Payment for acquisition of immovable property | 1% | 0.75% |

| 14 | 194-IB | Payment of rent by individual or HUF | 5% | 3.75% |

| 15 | 194-IC | Payment for Joint Development Agreements | 10% | 7.5% |

| 16 | 194J | Fee for Professional or Technical Services (FTS), Royalty, etc. | 2% (FTS, certain royalties, call centre)10% (others) | 1.5% (FTS, certain royalties, call centre)7.5% (others) |

| 17 | 194K | Payment of dividend by Mutual Funds | 10% | 7.5% |

| 18 | 194LA | Payment of Compensation on acquisition of immovable property | 10% | 7.5% |

| 19 | 194LBA(1) | Payment of income by Business trust | 10% | 7.5% |

| 20 | 194LBB(i) | Payment of income by Investment fund | 10% | 7.5% |

| 21 | 194LBC(1) | Income by securitisation trust | 25% (Individual/HUF)30% (Others) | 18.75% (Individual/HUF)22.5% (Others) |

| 22 | 194M | Payment to commission, brokerage etc. by Individual and HUF | 5% | 3.75% |

| 23 | 194-O | TDS on e-commerce participants | 1%(w.e.f. 1.10.2020) | 0.75% |

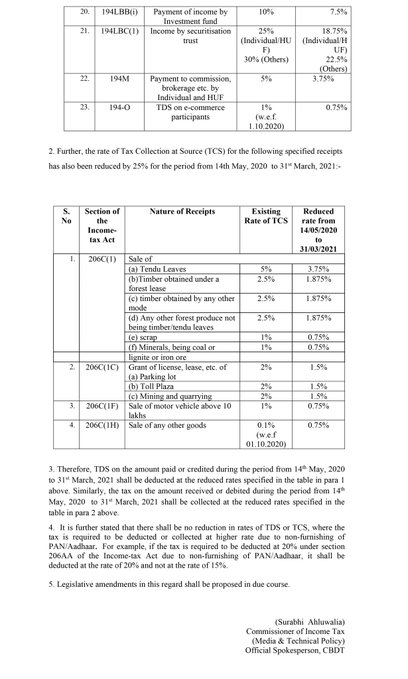

TCS Rate Chart for FY 2020-21 Pre & Post 14th May 2020:

| S. No | Section of the Income-tax Act | Nature of Receipts | Existing Rate of TCS | Reduced rate from 14/05/2020 to 31/03/2021 |

| 1 | 206C(1) | Sale of | ||

| (a) Tendu Leaves | 5% | 3.75% | ||

| (b)Timber obtained under a forest lease | 2.5% | 1.875% | ||

| (c) timber obtained by any other mode | 2.5% | 1.875% | ||

| (d) Any other forest produce not being timber/tendu leaves | 2.5% | 1.875% | ||

| (e) scrap | 1% | 0.75% | ||

| (f) Minerals, being coal or lignite or iron ore | 1% | 0.75% | ||

| 2 | 206C(1C) | Grant of license, lease, etc. of(a) Parking lot | 2% | 1.5% |

| (b) Toll Plaza | 2% | 1.5% | ||

| (c) Mining and quarrying | 2% | 1.5% | ||

| 3 | 206C(1F) | Sale of motor vehicle above 10 lakhs | 1% | 0.75% |

| 4 | 206C(1H) | Sale of any other goods | 0.1%(w.e.f 01.10.2020) | 0.075% |

We are providing practical training (Labor Laws, Payroll, Salary Structure, PF-ESI Challan) and Labor Law, Payroll Consultant Service & more:

- HR-Generalist-Practical-Training: https://oneclik.in/hr-generalist-practical-training/ (PF, ESI, Bonus, Payroll & more)

- Labour-Law-Practical-Training: https://oneclik.in/labour-law-practical-training/ (Factory, Contact Labor, Maternity Act & more)

- PF – ESI Consultant Service: https://oneclik.in/pf-esi-consultant-service/

- Labor Law, Compliance & HR – Payroll Management

To get connected & for latest HR, IR, Labor Law Updates:

- Telegram Channel: “One Clik”

- Whatsapp Group: https://wa.me/919033016939

- Facebook: One Clik

- Linkedin: One Clik

- Instagram: oneclik_hr_management