![]()

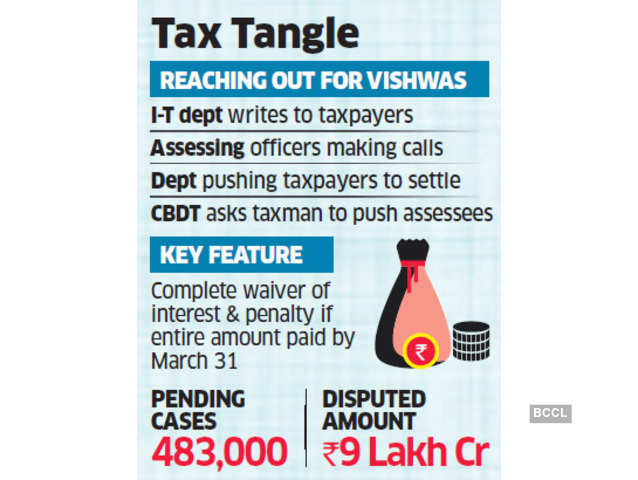

NEW DELHI: The income tax department is asking companies and individuals engaged in tax disputes to settle cases under the Vivaad Se Vishwas scheme even though the relevant law is yet to be passed by Parliament.

Tax experts said that the department is pushing taxpayers, including those based overseas, to settle but the government maintains that it’s only “encouraging” them to do so.

“It is seen from records that (there is) litigation pending between you and the department,” reads one such letter, a copy of which ET has seen. It asks the company concerned to contact the relevant officers in case it’s interested in availing of the scheme.

The Vivaad Se Vishwas (from dispute to trust) scheme was announced by finance minister Nirmala Sitharaman in the budget presented on February 1.

I-T Aggressive in Pursuing Revenue

Assessing officers are also said to be making phone calls to taxpayers, asking them to opt for the scheme that offers interest and penalty rebates if a settlement is reached before March 31.

“The tax department has become quite aggressive in pursuing revenues in wake of shortfall,” said Amit Maheswari, partner, Ashok Maheshwary & Associates LLP. “Enforcing pending tax demands by attaching bank accounts coupled with the drive to settle cases under the Vivaad Se Vishwas scheme is making life difficult for taxpayers.”

Maheswari said that appeals commissioners were delaying decisions on cases and instead asking taxpayers to settle under the proposed scheme.

The Central Board of Direct Taxes (CBDT) has told field officers that annual appraisals and postings will depend on their success in getting taxpayers to opt for the scheme.

Revenue secretary Ajay Bhushan Pandey had earlier told ET there would be no coercion. He said the department had asked field offices to reach out to taxpayers to explain the modalities of the scheme so that they can make an informed choice.

“We are facilitating… We are not forcing anyone… Person must be given a choice,” he had said. “They have been asked to reach out to explain them pros and cons of the scheme.”

Experts said there should be no pressure on taxpayers.

“These letters are welcome, so far as taxpayer’s information and education is concerned,” said Shailesh Kumar, partner, Nangia & Co LLP. “However, on practical implementation side, it would be important that the final decision be left on the respective taxpayers without really exercising any pressure to opt for the scheme.”

Kumar said taxpayers who were not aware of the scheme have begun reaching out to their tax advisors after getting the letters.

Mumbai-based tax consultant Dilip Lakhani said the current cash crunch could be an issue.

“The frantic attempt by Central Board of Direct Taxes to collect Rs 50,000 crore by March 31 under the Vivaad Se Vishwas scheme may find a hurdle as the corporates are facing heavy cash crunch and those matters which are pending before first appellate authority are already stayed on making the prescribed payment of 15-20% of disputed tax,” he said.

There are 483,000 direct tax cases worth over Rs 9 lakh crore pending before various appellate for a — the Income Tax Appellate Tribunal (ITAT), high courts and the Supreme Court.

Public sector banks and government-owned companies aren’t too keen on opting for the scheme, ET reported on March 2, on the grounds that the demands are unjustified or too high.