![]()

Normally, tax benefits on life insurance premium is available under section 80C of the Income Tax Act. However, the annual limit of tax benefit u/s 80C currently is Rs 1.5 lakh and apart from life insurance premium, the section contains many other investments/expenses that contains payment of tuition fee for education of up to two children, repayment of home loan principal, contribution to PF (employee’s contribution), ULIP, PPF and Sukanya Samriddhi Yojana Account, investments in ELSS, NSC, FD for 5 years or more, etc.

80C Limit

Due to the presence of so many components, the annual 80C limt of Rs 1.5 lakh gets exhausted quickly and taxpayers couldn’t get benefits on many other tax-saving investments.

LTC Scheme

However, due to restrictions in movement amid the Covid-19 pandemic this year (FY 2020-21), the government has declared the LTC Scheme in lieu of the Leave Travel Concession that allows the salaried beneficiaries to claim tax benefits on expenses made between October 12, 2020 to March 31, 2021 on purchase of good and availing services that attract GST rate of 12 per cent or more instead of travel expenses.

Benefit on Life Insurance

Among the services, life insurance is also included in the LTC Scheme. However, in case the benefit is already claimed on premium payment u/s 80C, it can’t be claimed under the LTC Scheme. So, in case your 80C limit is exhausted, you may still claim benefits under the LTC Scheme. Otherwise, you have to choose whether you want to claim the benefit u/s 80C or under the LTC Scheme.

Conditions for Claiming Benefit

Moreover, the benefit under the LTC Scheme will be allowed on premium paid for new policies issued between October 12, 2020 to March 31, 2021 only and not on renewal premium. So, to avail the benefit, you have to purchase a new life insurance policy – be it a term plan or a ULIP or an annuity or an endowment plan.

Amount of Benefit

If you purchase a single premium plan within the eligibility period, you would get tax benefit on the entire premium or your maximum LTC benefit amount, whichever is lower. But for regular premium policies issued in that period, you will get benefits on the amount of premium paid till March 31, 2021, provided the aggregate amount is within your LTC limit.

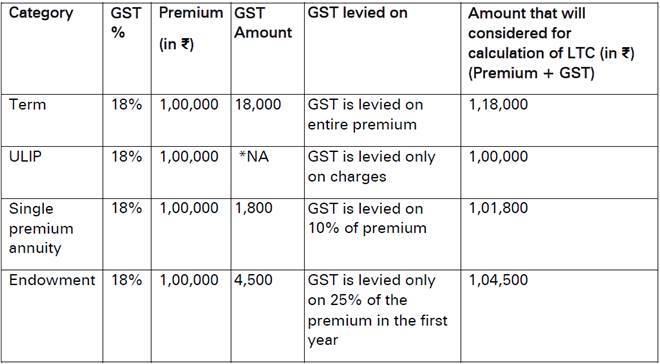

The following table shows the amount that will be considered for calculation of LTC for different categories of policies:

We are providing practical training (Labor Laws, Payroll, Salary Structure, PF-ESI Challan) and Labor Law, Payroll Consultant Service & more:

- HR-Generalist-Practical-Training: https://oneclik.in/hr-generalist-practical-training/ (PF, ESI, Bonus, Payroll & more)

- Labour Code | Labour Bill (Labour-Law-Practical-Training): https://oneclik.in/labour-law-practical-training/ (Factory, Contact Labor, Maternity Act & more)

- PF – ESI Consultant Service: https://oneclik.in/pf-esi-consultant-service/

- Labor Law, Compliance & HR – Payroll Management

- Advance Excel Practical Training

Get Latest HR, IR, Labor Law Updates, Case Studies & Regular Updates: (Join us on Social Media)

- Telegram Channel: “One Clik”

- Whatsapp Group: https://wa.me/919033016939

- Facebook: One Clik

- Linkedin: One Clik

- Instagram: oneclik_hr_management

- YouTube: One Clik