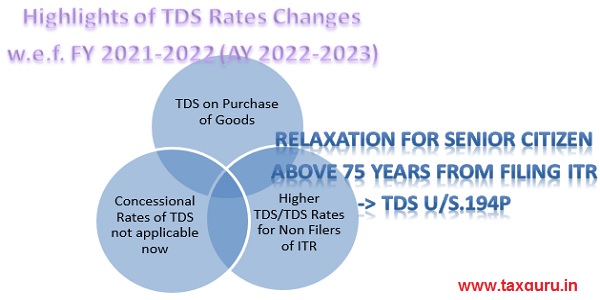

New TDS Rules That Will Effect From July 1, 2021

![]()

Non-filers will face a higher penalty in the current fiscal year, which has already started from April 1, 2021. The Finance Act 2021, which was recently passed by Parliament, has a “Special provision for deduction of tax at source for non-filers of income-tax return.” After section 206AA of the Income Tax Act, a new section […]

New TDS Rules That Will Effect From July 1, 2021 Read More »