![]()

Suggestions in respect of the glitches on the New Income Tax portal were invited online. More than 700 emails detailing over 2000 issues including 90 unique issues/problems in the portal were received from various stakeholders including ICAL tax professionals and tax payers. Moreover, multiple interactions have been held with the representatives from ICAI and tax professionals.

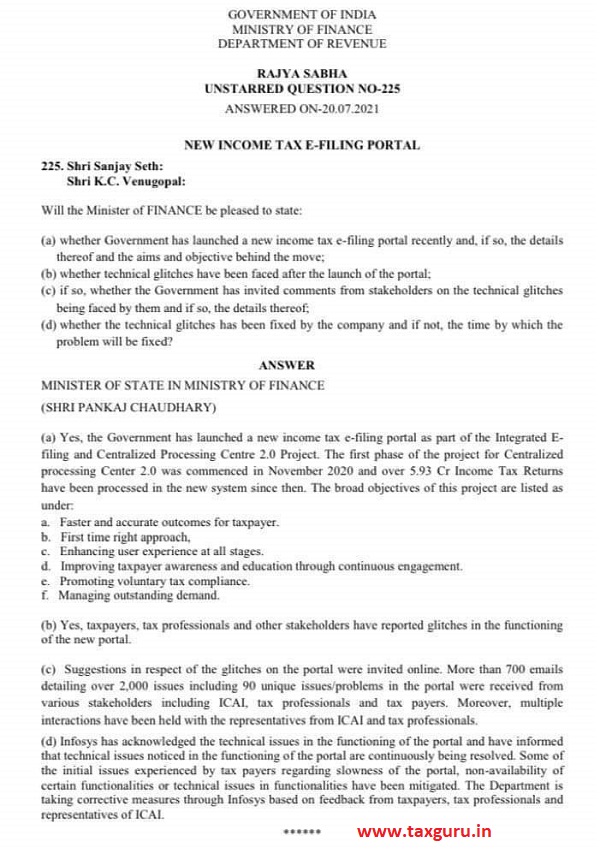

EW INCOME TAX E-FILING PORTAL

225. Sbri Sanjay

Seth: Mari K.C. Venugopal:

Will the Minister of FINANCE be pleased to state:

(a) whether Government has launched a new income tax e-filing portal recently and, if so, the details thereof and the aims and objective behind the move;

(b) whether technical glitches have been faced after the launch of the portal:

(c) if so, whether the Government has invited comments from stakeholders on the technical glitches being faced by them and if so, the details thereof.

(d) whether the technical glitches has been fixed by the company and if not, the time by which the problem will be fixed?

ANSWER

MINISTER OF STATE IN MINISTRY OF FINANCE

(SHRI PANKAJ CHAUDHARY)

(a) Yes, the Government has launched a new income tax e-filing portal as pan of the Integrated E-filing and Centralized Processing Centre 2.0 Project. The first phase of the project for Centralized processing Center 2.0 was commenced in November 2020 and over 5.93 Cr Income Tax Returns have been processed in the new system since then. The broad objectives of this project are listed as under

a. Faster and accurate outcomes for taxpayer.

b. First time right approach.

c. Enhancing user experience at all stages.

d. Improving taxpayer awareness and education through continuous engagement.

e. Promoting voluntary tax compliance.

f. Managing outstanding demand.

(b) Yes, taxpayers, tax professionals and other stakeholders have reported glitches in the functioning of the new portal.

(c) Suggestions in respect of the glitches on the portal were invited online. More than 700 emails detailing over 2000 issues including 90 unique issues/problems in the portal were received from various stakeholders including ICAL tax professionals and tax payers. Moreover, multiple interactions have been held with the representatives from ICAI and tax professionals.

(d) lnfosys has acknowledged the technical issues in the functioning of the portal and have informed that technical issues noticed in the functioning of the portal are continuously being resolved. Some of the initial issues experienced by tax payers regarding slowness of the portal, non-availability of certain functionalities or technical issues in functionalities have been mitigated. The Department is taking corrective measures through Infosys based on feedback from taxpayers, tax professionals and representatives of ICAI.

We are providing practical training (Labor Laws, Payroll, Salary Structure, PF-ESI Challan) and Labor Codes, Payroll Consultant Service & more:

- HR Generalist Practical Training: https://oneclik.in/hr-generalist-practical-training/

- Labor Law + Payroll-Practical-Training: https://oneclik.in/labor-law-payroll-practical-training-certificate/ (PF, ESI, Bonus, Payroll & more)

- Labor Code, 2020 (Crash Course): https://oneclik.in/labor-code2020-rules-practical-training-certificate-crash-course/

- Labour Code | Labour Bill (Labour-Law-Practical-Training): https://oneclik.in/labour-law-practical-training/ (Factory, Contact Labor, Maternity Act & more)

- PF – ESI Consultant Service: https://oneclik.in/pf-esi-consultant-service/

- Labor Law, Compliance & HR – Payroll Management

- Advance Excel Practical Training: https://oneclik.in/advanced-excel-practical-training-certificate/

Get Latest HR, IR, Labor Law Updates, Case Studies & Regular Updates: (Join us on Social Media)

- Telegram Channel: “One Clik”

- Whatsapp Group: https://wa.me/919033016939

- Facebook: One Clik

- Linkedin: One Clik

- Instagram: oneclik_hr_management

- YouTube: One Clik