![]()

“Suppose you are making payment to a contractor. And, when you’re getting the work executed, you’re supposed to deduct TDS at 2% — that’s the normal rate. If I made a payment of ₹ 1 crore, I deducted TDS of ₹2 lakh and deposited it in his account.,” explained Ved Jain, former President of The Institute of Chartered Accountants of India (ICAI) told Business Insider.

“Starting from December 2021-22, I will ask him if he has filed returns for the last two years or not. For years 2018-19 and 2019-20. If he has filed for any of these, I will continue to deduct 2%. But, if he has not filed returns of the last two years, then I need to deduct at 5%,” he said.

This provision has been brought in by Finance Minister Nirmala Sitharaman in the latest budget to tighten the leash on those who haven’t filed their income tax returns. This new provision comes into effect from 1 July 2021.

However, it may be the case that some of the stick may hit those making the payment to the lax taxpayer, and therefore collecting the tax at source. The burden of compliance is on the the person— who may be a prompt filer of returns— deducting the tax.

Some will have no choice but to pay double the tax

The new proposal means that those who haven’t filed their tax returns in 2018-19 and 2019-20 may be in trouble. Some corporates already take a declaration, before processing payments, from their usual vendors that they have filed their returns.

For transactions involving individuals, like contractors, artists and freelancers, and businesses in the unorganised sector, the situation is a little more complicated.

How do you know if the person you are transacting with has filed returns?

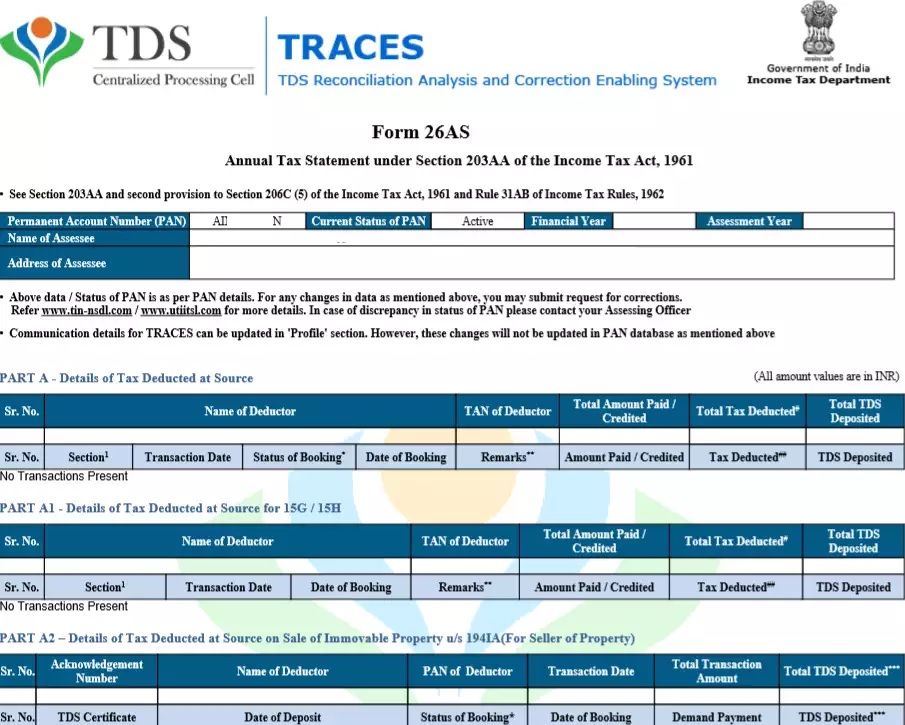

Deductors can check whether or not returns have been filed on the Income Tax Department’s official website. There is a utility available where the PAN number can be given, and deductors can check the last returns filed by an individual. “That utility is in the public domain,” said Jain.

Wherever TDS or TCS applies, it should automatically come in Form 26AS and return filing could be ascertained through it.

But it is still easier said than done for most people. “This is an additional burden of compliance for deductors. No additional remedy has been provided for cases where ITR filing was not applicable in the two previous years. Taxpayers who foresee facing this issue should prepare to file ITR for FY 2020-21 in due course,” Archit Gupta, founder and CEO, ClearTax told Business Insider.

Unanswered questions about the new TDS rule*

The primary challenge that emerges from the proposed amendment is the ability of the deductor to determine whether the deductee or collectee has filed their income tax returns for the previous two years, according to Taxmann. The onus will also be on the deductor to determine whether the aggregate TDS and TCS over the last two years was more or less than ₹50,000.

Another uncertainty is whether the deductee was mandatorily required to furnish their income tax return. For instance, individuals who don’t fall under any taxable bracket or if they are an NRI earning only dividend, interest, royalty or fees for technical services — as specified in section 115A of the Act — will they also be penalised for not submitting their TDS or TCS over the last two years.

Taxmann points out that in cases where the due date of filing of return has not expired, should a deductor obtain a declaration from the deductee that the income-tax return will be filed within the prescribed due date and will such declaration be admissible?

“It is also possible that the deductee or collectee may refrain from furnishing particulars of their income tax return with the deductors/clients. As a result, the onus of gathering information from the deductee or collectee shall trammel the deductors from ease of functioning and may impose additional compliances in terms of revision of e-TDS returns in case the information is retrieved belatedly from the deductee,” says Taxmann.

We are providing practical training (Labor Laws, Payroll, Salary Structure, PF-ESI Challan) and Labor Law, Payroll Consultant Service & more:

- HR-Generalist-Practical-Training: https://oneclik.in/hr-generalist-practical-training/ (PF, ESI, Bonus, Payroll & more)

- Labour Code | Labour Bill (Labour-Law-Practical-Training): https://oneclik.in/labour-law-practical-training/ (Factory, Contact Labor, Maternity Act & more)

- PF – ESI Consultant Service: https://oneclik.in/pf-esi-consultant-service/

- Labor Law, Compliance & HR – Payroll Management

- Advance Excel Practical Training

Get Latest HR, IR, Labor Law Updates, Case Studies & Regular Updates: (Join us on Social Media)

- Telegram Channel: “One Clik”

- Whatsapp Group: https://wa.me/919033016939

- Facebook: One Clik

- Linkedin: One Clik

- Instagram: oneclik_hr_management

- YouTube: One Clik