E-PAN | All You Need To Know About The Digital Version Of Your PAN Card

![]()

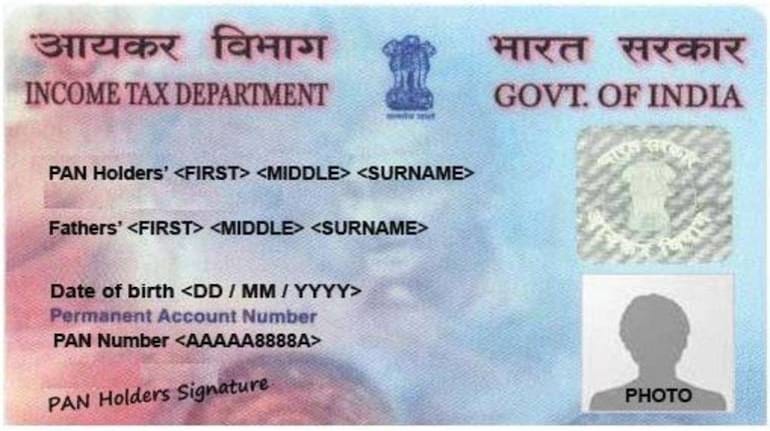

All of us know how important Permanent Account Number or PAN is. It is not only an identity proof but an important document for financial transactions and for filing income tax returns. e-PAN is a valid proof of PAN. e-PAN has a QR code that possesses demographic details of PAN card holders such as the […]

E-PAN | All You Need To Know About The Digital Version Of Your PAN Card Read More »